ASEAN emerging as “Pseudo‐China”

Author: Richa Shukla

As the world’s largest export-oriented economy, the fastest-growing consumer market and the largest trading nation, China has always played a prominent role in international trade. Keeping pace with the increased globalization, China has been taking steps to increase its participation in trade organizations and to sign treaties and free trade agreements / regional trade agreements. One such regional trade agreement signed by China PR was the ASEAN–China Free Trade Area (ACFTA), signed in November 2002.

The Agreement creates a free-trade area among the ten member states of the Association of South-East Asian Nations (ASEAN) and the People’s Republic of China. Pursuant to the ACFTA, China and ASEAN signed the ‘Agreement on Trade in Goods’ of the China-ASEAN FTA, the ‘Agreement on Trade in Services’ and the ‘Agreement on Investment’ in July 2005, January 2007 and August 2009, respectively.

The objective of the ACFTA was to enhance the economic and trade relations between China and the ASEAN member nations. Further, it was expected to help in the development of the ASEAN member nations, through greater trade liberalization, deregulation, lowering the cost of doing business and influx of capital from China. The ACFTA has also accelerated the growth of direct investments by China and commercial cooperation between China and ASEAN.

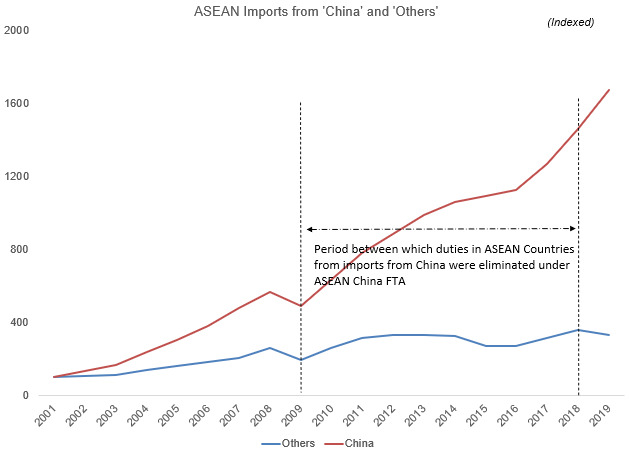

However, the ACFTA has had an unexpected side effect. Till date, most of the other WTO members consider China as a Non-Market Economy (NME) in antidumping investigations. This implies that the costs and prices, including the costs of raw materials and energy in China, are considered to be distorted as a result of government intervention and not governed by free market-forces. As a result, China has seen extremely high anti-dumping duties being levied against its exports. This has adversely impacted the exports from China. Presumably, this may have been one of the reasons that China has consciously pushed for increased trade and economic integration with ASEAN region. It would be seen that post relaxation of customs duty under ACFTA, the imports of goods from China into ASEAN have increased steeply, when compared to imports from other sources. A major share of these imports is meant for the purpose of production of export goods, and not for domestic consumption.

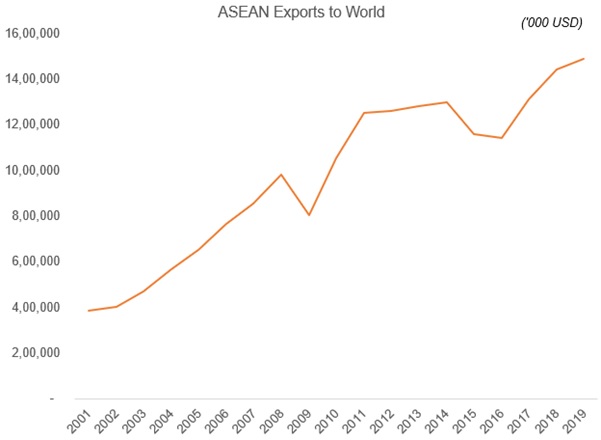

With the increase in imports from China, it would be seen that the exports from ASEAN to the world have increased sharply.

These trends show that the producers in China have increased exports of intermediary products to ASEAN, for processing into the finished product for export to other countries. Reports suggest that anti-dumping duties imposed against Chinese exports may have been one of the reasons which prompted Chinese companies to relocate their manufacturing plants to ASEAN member nations. There are a number of reports which suggest that Chinese investments in ASEAN have been encouraged through subsidies provided by the Government of China to expand in overseas markets. The movement of raw materials from China to ASEAN member nations has increased for conversion into finished goods. In some cases, the value addition involved is nominal.

There have also been allegations that finished goods from China are exported to ASEAN, for the purpose of further trading. It has been alleged that these finished goods are re-packaged in the territory of ASEAN member nations and exported to the rest of the world by mis-declaring the country of origin as one of the ASEAN member nations, instead of China. There have been apprehensions of such mis-declaration in many sectors, ranging from agriculture, materials used in FMCG industry to core sectors like Steel & Aluminium.

The Rules of Origin under the India-ASEAN Free Trade Agreement provide that the country of origin shall be considered as the FTA partner, if certain minimum value addition is being carried out within the ASEAN region. However, in some cases, it has been alleged that the Rules of Origin have not been followed, and the exporters have been able to obtain Certificates of Origin, in contravention of the value addition requirements.

Another issue arising as a result of increased export of intermediary goods from China to ASEAN is the pass-through of subsidies in raw materials as well as finished goods. Pass through of subsidies implies a situation wherein a downstream producer obtains subsidized inputs from an upstream producer. In such cases, the benefits of subsidies availed by the upstream producer flow down to the downstream producer. Normally, such pass-through subsidies are covered within the scope of anti-subsidy investigations and subjected to countervailing / anti-subsidy duty.

However, a problem arises in case of cross-border pass through subsidies. A cross-national pass through of subsidies occurs where a downstream producer in a country obtains subsidized inputs from an upstream producer from another country. In the context of the present discussion, it refers to a situation where the primary raw material is subsidized by the Government of China and the same subsidized raw material is imported by the producer/exporter in the ASEAN member nations. However, these subsidies cannot be covered within the scope of an anti-subsidy investigation against the ASEAN member nation. Under the Agreement on Subsidies and Countervailing Measures, there must be a financial contribution by the Government that confers a benefit to a recipient. Here, the Agreement refers to the Government of the country exporting the product under consideration only. Thus, any subsidies provided by the Government of China in respect of the inputs exported by China to ASEAN cannot be covered within the scope of investigation into export of finished goods from ASEAN. Thus, the countervailing duties levied do not adequately address trade distortion.

Lastly, the export of intermediary products from China to ASEAN also prevents adequate anti-dumping duties from being levied, to offset the extent of price distortion. As mentioned above, China is considered as a Non-Market Economy, due to which its costs and prices are not considered for determination of the dumping margin. However, the members of ASEAN are considered as market economies, which means that their costs are to be considered in the determination of dumping margin, including those related to procurement of inputs from China or otherwise. While there are certain exemptions to this principle, it largely implies that the anti-dumping duties cannot adequately counteract any Government influence on costs of inputs imported from China.

It is thus clear that the ACFTA has adversely impacted the interests of the Indian producers as well as global trade. While on one hand, there are allegations of mis declaration of country of origin; on the other hand, the antidumping and anti-subsidy investigations against imports from ASEAN member nations are unable to adequately remedy the unfair pricing. Therefore, there is a need for increased discussions to examine the issue in detail, to lift the Chinese veil and look behind with particular focus on establishing general Rules of Origin, ensuring stricter compliance, capturing of cross-national subsidies and the effect of price distortion in respect of inputs imported from China into ASEAN.