The Australia-India Economic Cooperation and Trade Agreement (ECTA) came into force on 29th December 2022. The Ministry of Finance has notified the Rules of Origin through Notification No. No. 112/2022-Customs (N.T.) dated 22nd December 2022, named Customs Tariff (Determination of Origin of Goods under the India-Australia Economic Cooperation and Trade Agreement) Rules, 2022. Following are the key features of the Rules:

Originating and Non-Originating Goods

The Rules provide that the following goods shall be considered as originating from Australia

- Goods will be considered to be ‘Originating’ in a country if they are produced within the territory of that country using goods obtained or produced in that country, such as plant and plant goods, minerals and other naturally occurring substances etc.

- In case of goods not wholly produced, the goods must satisfy the following two conditions

- They must satisfy Product Specific Rules of Origin or have undergone at least a change in tariff sub heading and

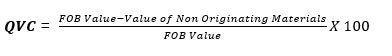

- They must meet the Qualifying Value Content (QVC) requirement of not less than thirty-five percent of the FOB value as per build-up formula or forty-five percent of the FOB value calculated as per build-down formula.

- Moreover, any good will be treated as originating good if the value or weight of the non-originating materials used in the production does not exceed 10% of the FOB value or weight of the good.

The formula for calculation of QVC is below.

(a) Build-Down Formula: based on the value of non-originating materials

(b) Build-up Formula: based on the value of originating materials

If only minimal operations have been performed on the non-originating materials, then the goods will not be granted the status of originating goods.

Application and Issuance of the Certificate of Origin

To avail the lower customs duties. a ‘Certificate of Origin’ issued by the exporting authorities is required to be presented at the time of import. The certificate will be valid till twelve months from the date on which it was issued and will only apply to a single transaction of import. It may be issued prior to or within 5 working days of the date of exportation. It may also be issued retrospectively with proper disclosure and reasoning. An application with supporting information and documents is required to be filed with the issuing body or authority of the exporting country.

Importing at concessional rate

As per the Rules, in order to receive the preferential tariff treatment, an importer will be required to

- make declaration stating that the goods qualify as originating goods

- provide a valid Certificate of Origin and

- demonstrate compliance of certain requirements of the Rules in case consignments have been transported directly from the exporting country or through third countries.

An importer can even apply for preferential tariff rates and a refund of the duties paid after imports, subject to certain conditions.

Verification

The Rules further provide that the issuing authority may also conduct random pre-export verification of the documents filed by the exporter or the customs authority of the importing country may conduct a verification process to determine the origin of the goods. In certain situations, the importing country can deny the preferential tariff treatment or temporarily suspend the preferential treatment. Further, both the countries have laid down measures of civil, administrative, and criminal sanctions in case of violation of customs laws and regulations.